Discovering the Conveniences and Threats of Purchasing Cryptocurrencies

The landscape of copyright investment is identified by an intricate interplay of engaging advantages and substantial threats. As we even more analyze the nuances of copyright financial investment, it comes to be noticeable that informed decision-making is vital; nevertheless, the concern stays: How can capitalists efficiently stabilize these benefits and risks to protect their financial futures?

Recognizing copyright Essentials

As the electronic landscape develops, recognizing the basics of copyright comes to be crucial for prospective capitalists. copyright is a type of digital or online currency that uses cryptography for security, making it difficult to copyright or double-spend. The decentralized nature of cryptocurrencies, generally developed on blockchain modern technology, improves their security and openness, as purchases are videotaped across a distributed journal.

Bitcoin, produced in 2009, is the initial and most popular copyright, yet countless alternatives, called altcoins, have arised given that after that, each with distinct attributes and functions. Financiers must acquaint themselves with crucial concepts, consisting of purses, which store private and public tricks required for purchases, and exchanges, where cryptocurrencies can be purchased, sold, or traded.

In addition, recognizing the volatility related to copyright markets is vital, as costs can fluctuate considerably within brief periods. Governing considerations likewise play a substantial role, as various countries have varying stances on copyright, impacting its use and acceptance. By grasping these fundamental elements, possible investors can make informed decisions as they browse the complicated globe of cryptocurrencies.

Key Advantages of copyright Financial Investment

Purchasing cryptocurrencies offers numerous compelling advantages that can attract both beginner and skilled financiers alike. Among the key benefits is the capacity for substantial returns. Historically, cryptocurrencies have actually shown impressive rate admiration, with early adopters of properties like Bitcoin and Ethereum understanding substantial gains.

An additional key benefit is the diversification possibility that cryptocurrencies offer. As a non-correlated asset class, cryptocurrencies can function as a hedge versus conventional market volatility, allowing capitalists to spread their threats across various investment vehicles. This diversity can improve general profile efficiency.

Furthermore, the decentralized nature of cryptocurrencies supplies a degree of freedom and control over one's properties that is often doing not have in traditional money. Financiers can handle their holdings without intermediaries, possibly minimizing charges and increasing transparency.

In addition, the growing acceptance of cryptocurrencies in mainstream financing and commerce even more solidifies their value proposition. Lots of companies currently approve copyright repayments, leading the way for more comprehensive fostering.

Finally, the technological technology underlying cryptocurrencies, such as blockchain, offers chances for financial investment in emerging fields, consisting of decentralized money (DeFi) and non-fungible tokens (NFTs), improving the financial investment landscape.

Major Dangers to Consider

Another critical danger is governing unpredictability. Governments around the globe are still developing plans pertaining to cryptocurrencies, and modifications in regulations can drastically affect market characteristics - order cryptocurrencies. A negative regulatory environment could restrict trading or perhaps lead to the outlawing of specific cryptocurrencies

Safety threats likewise present a considerable threat. Unlike standard financial systems, cryptocurrencies are at risk to hacking and fraud. Investor losses can take place if exchanges are hacked or if personal tricks are compromised.

Finally, the lack of consumer protections in the copyright space can leave investors susceptible - order cryptocurrencies. With limited option in the event of fraud or burglary, people may discover it challenging to recoup lost funds

Due to these risks, detailed research study and danger analysis are vital prior to participating in copyright investments.

Approaches for Effective Investing

Developing a durable technique is necessary for browsing the intricacies of copyright investment. Investors must begin by carrying out thorough study to comprehend the underlying navigate to this site technologies and market dynamics of different cryptocurrencies. This includes remaining notified concerning fads, governing developments, and market view, which can significantly influence asset performance.

Diversification is another crucial method. By spreading financial investments across multiple cryptocurrencies, capitalists can alleviate risks related to volatility in any kind of solitary property. A healthy portfolio can supply a barrier versus market variations while improving the capacity for returns.

Establishing clear investment objectives is vital - order cryptocurrencies. Whether going for short-term gains or lasting wealth build-up, specifying certain purposes assists in making notified choices. Implementing stop-loss orders can likewise protect investments from considerable declines, permitting a regimented departure technique

Last but not least, constant monitoring and review of the investment approach is crucial. pop over to this site The copyright landscape is vibrant, and on a regular basis examining efficiency versus market problems makes sure that capitalists remain dexterous and responsive. By sticking to these methods, financiers can enhance their possibilities of success in the ever-evolving globe of copyright.

Future Trends in copyright

As capitalists fine-tune their methods, understanding future patterns in copyright comes to be progressively important. The landscape of electronic money is developing quickly, affected by technological improvements, regulative advancements, and changing market characteristics. One significant fad is the increase of decentralized money (DeFi), which aims to recreate traditional economic systems utilizing blockchain innovation. DeFi protocols are getting traction, using cutting-edge financial products that can improve exactly how individuals involve with their properties.

Another emerging pattern is the expanding institutional passion in cryptocurrencies. As business and financial establishments adopt electronic currencies, mainstream approval is most likely to increase, potentially leading to higher cost stability and liquidity. In addition, the assimilation of blockchain modern technology right into different markets hints at a future where cryptocurrencies serve as a foundation for deals across industries.

Moreover, the governing landscape is progressing, with governments seeking to develop frameworks that balance development and customer protection. This governing clarity might foster an extra secure investment setting. Innovations in scalability and energy-efficient consensus systems will certainly deal with concerns bordering deal rate and environmental influence, making cryptocurrencies extra sensible for day-to-day use. Comprehending these trends will be essential for informative post investors seeking to navigate the complexities of the copyright market properly.

Final Thought

Jenna Jameson Then & Now!

Jenna Jameson Then & Now! Sam Woods Then & Now!

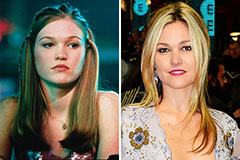

Sam Woods Then & Now! Julia Stiles Then & Now!

Julia Stiles Then & Now! Catherine Bach Then & Now!

Catherine Bach Then & Now! McKayla Maroney Then & Now!

McKayla Maroney Then & Now!